Fremont Votes on FUSD Parcel Tax

Fremont Unified School District (FUSD) placed Measure L, a $296 district-wide education parcel tax expected to generate approximately $18.3 million in yearly revenue, on the ballot for the March 3, 2020 vote. If adopted, the parcel tax would be instituted for 9 years and be an additional source of revenue to bolster schools currently struggling with budget deficit across the district.

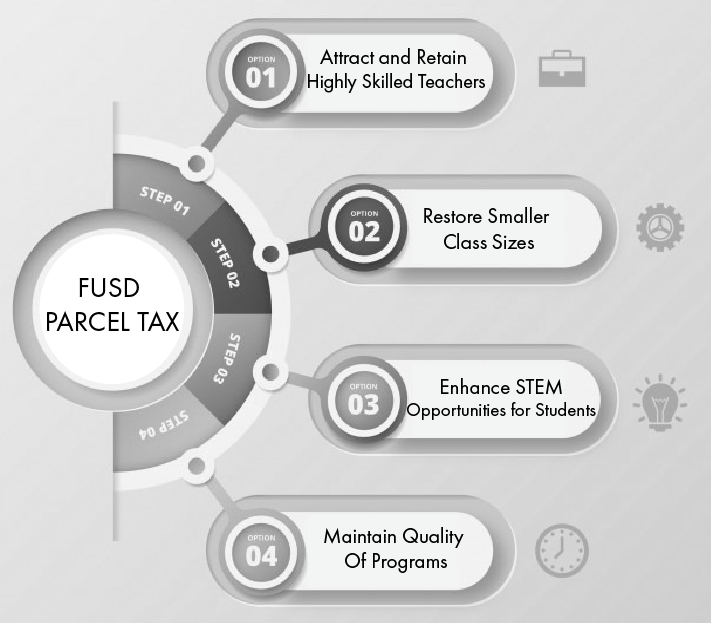

According to FUSD, Measure L aims to target certain overarching goals with the funding generated through the parcel tax, primarily to “attract and retain highly qualified teachers” in the classroom and “enhance STEAM opportunities for students” inside and outside of school. Additionally, the parcel tax would contribute to “restoring smaller class sizes” while maintaining the quality of programs.

“It’s less than a dollar a day,” said FUSD School Board Trustee Ann Crosbie, “and it will make sure that we support having lower class sizes… STEAM programs, [and] that we support our teachers and keep really highly qualified teachers here in Fremont.”

With Fremont schools receiving one of the lowest per-student state funding in the county (based on information provided by the FUSD website), the parcel tax proposes to mitigate the impact of expected budget cuts to staff and academic programs in the 2020- 2021 school year.

“Without the parcel tax passing, we are going to be making cuts,” said Crosbie. The School Board is set to have a discussion on potential cuts that could be made, and to discuss the 24 million dollars in cuts they will be forced to make across the district.

As it is a uniquely local tax, funds raised through the measure would stay within the district and outside of state-level jurisdiction. In order to address growing community concerns about administrative salaries being too high, the language of the parcel tax specifically prohibits allocating the funding for central district administration or administrative salaries. Instead, funds generated through the measure may be used to train or hire new teachers in order to encourage smaller class sizes amid the ever-growing class populations.

Additional concerns have sprouted from the community about not seeing satisfactory results from the proposed projects.

“Certain areas feel like they haven’t received their share,” said Crosbie, “but it’s coming. The state understands that you are only able to build so much at once, so its planned out so certain projects are done in certain years. There are also a lot that people just don’t see, things that have been done. We have been doing wiring, we have been putting in Wi-Fi, but you don’t see that.”

Similarly to Measure E, a bond measure passed in 2014, the parcel tax aims to improve the instructional quality of education. However, Measure E has fundamentally different purposes, aimed at targeting infrastructure, construction, repair projects, and modernizing classrooms and science labs. Since Measure L is a general funding and not a bond measure, it requires 67% of voters to approve the tax, a higher voting threshold for passage than other measures.

“We polled the community and asked what do you want us to do?” said Crosbie. “So we asked three different dollar amounts, and we looked at what the community was in support of.”

A $296 tax per parcel (unit of property such as a single-family home or an apartment complex) was decided, and an independent oversight committee composed of Fremont citizens will check-back on the implementation of the parcel tax funding in the coming months. Other enforcement mechanisms, including yearly audits and reports to the community, are put in place to ensure responsible and equitable distribution of the parcel tax revenue.

“We have award winning schools, so people think, ‘Well we are already doing really well and making it work with what little we have’,” says Fahria Khan, president of the Fremont Education Foundation, at the parcel tax campaign kickoff at Jack’s Brewery on Thursday, February 6, 2020. “But the thing is, we could be doing so much better. Having this money is going to help bridge that gap.”