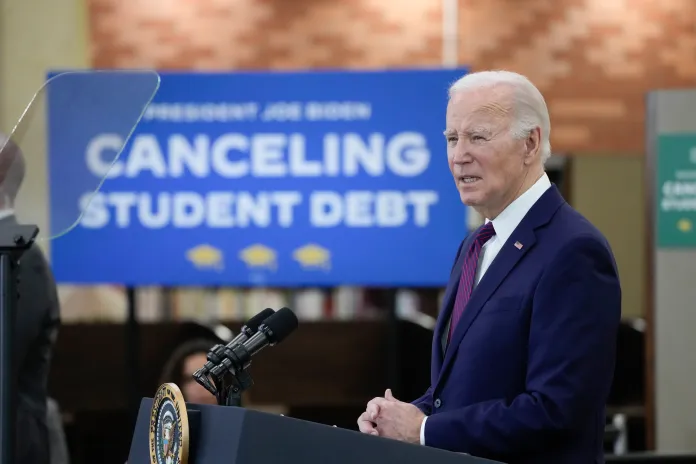

As Irvington’s Class of 2024 graduate and start college, the topic of student loans and student debts has become relevant for this year’s seniors. President Biden’s attempts at easing the burden of student loans have so far been struck down by the Supreme Court’s conservative supermajority. However, in a statement from the White House on April 8 he recently proposed a less broad and more targeted plan that aims to effectively cancel student debt for many Americans. This necessary but insufficient effort to help millions of indebted Americans requires public support for its passage.

The main source of conflict comes from a few who argue that student loan forgiveness is not necessary or even unfair. These people feel that forgiving student loans for millions of Americans is deeply unfair to the Americans who have already paid off their debt.

However, others point out that a plethora of external factors are the actual cause of long-term student loan debt in the first place. For example, poverty and race play a huge role in who can get out of debt easily. “Black students borrowed an average of $58,400,” states the National Center for Education Statistics. “Which was higher than the average amount borrowed by those who were Asian ($49,100), of Two or more races ($43,400), White ($43,300), Hispanic ($41,700), or American Indian/Alaska Native ($36,900).” This highlights the need for a more holistic consideration when selecting a forgiveness program. Moreover, helping those who are in need due to an unfair education and economic system does not take away much from those who are already well off due to benefiting from that same system.

Why is Student loan forgiveness needed in the first place? “The outstanding federal loan balance is $1.602 trillion,” states a report from the Education Data Initiative. “[This] accounts for 92.8% of all student loan debt.” This staggering amount of debt can have detrimental short and long-term impacts on the financial, mental, and physical health of many Americans. According to the Center for Law and Social Policy, over 9 million people have defaulted on their student debt. The effects of this range from hits to people’s credit scores to increased risk of poverty and homelessness for many.

Apart from these financial consequences, those in debt also face many health and mental problems, mainly caused by stress and anxiety. “78.7% of respondents report being anxious because of student loans,” states a survey conducted by Student Loan Planner. “1 in 16 survey respondents experienced suicidal ideation at some point due to student loans.” People also stop seeking medical and dental care as a result of the increased financial burden placed upon them by student loans.

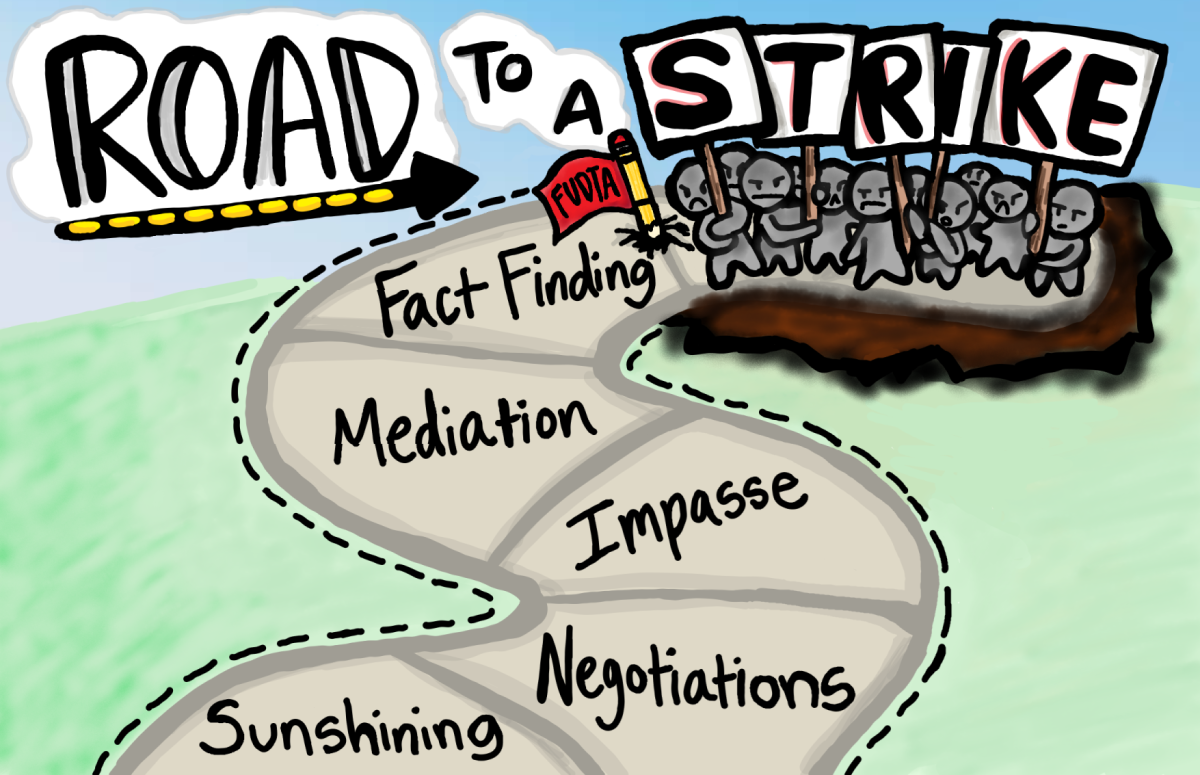

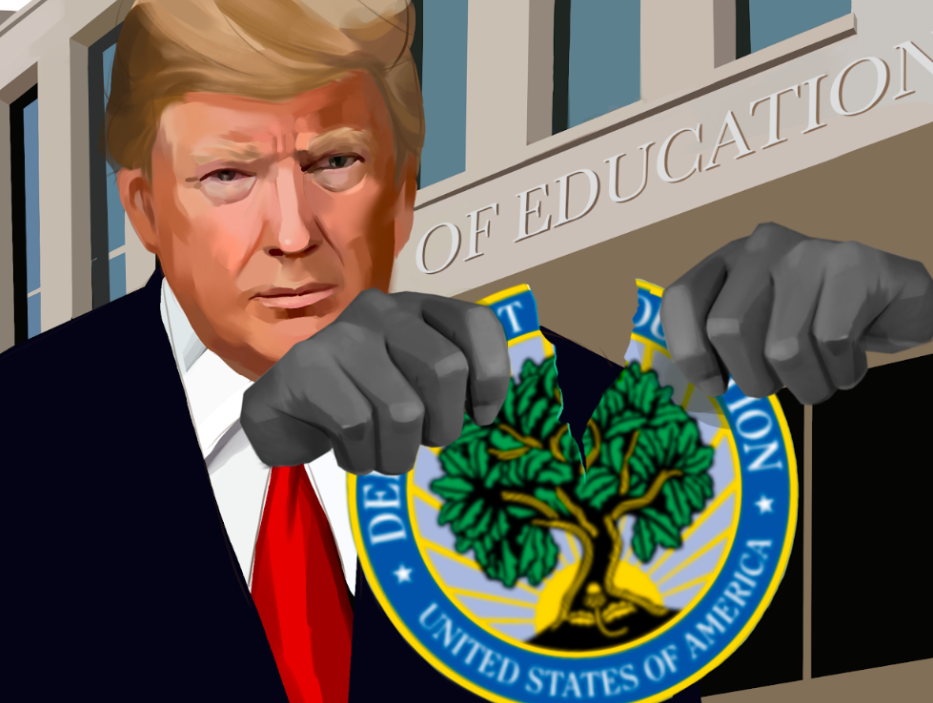

It is important to know how previous attempts fared when it came to implementation. Biden’s previous plan was shut down by the Supreme Court as they considered the loan forgiveness plan as a basic and fundamental change to the Higher Relief Opportunities for Students Act of 2003 or HEROES Act. As a result, the Court felt that the President overstepped his authority as he was only allowed to make small changes to the act. Even before Biden’s failed attempt, previous attempts at student loan forgiveness forgave less than 1% of the outstanding national student loan debt. After all of these ineffective attempts, some argue that Biden’s recent actions are a necessary step in the right direction and more needs to be done.

Biden’s new plan uses the Higher Education Act of 1965, which provides a different legal route than the previous plan to implement student loan forgiveness in order to approach this problem. However, opponents have criticized the plan’s downsides. They have argued that the new plan needs to be narrowed down in order to fit the qualifications outlined by the act. Compared to the previous plan which would have covered up to 43 million Americans, the new plan will only cover 30 million Americans overall. This 30% decrease in coverage means a decrease in the total impact President Biden hopes to have.

The new plan does bring with it some important benefits to those in debt though. “That includes fixing Public Service Loan Forgiveness and Income-Driven Repayment plans,” states the Biden-Harris administration. “It also includes launching the most affordable student loan repayment plan ever – the SAVE plan.” The Saving on a Valuable Education plan, also known as the SAVE plan, is an income-driven repayment plan that reduces monthly payments for low-income borrowers and eliminates interest payments that can’t be paid by using federal funds to pay them off.

While these actions may benefit many Americans overall, there is still the chance that the Supreme Court may find the President to have overstepped his authority. This has only increased restrictions and further reduced the scope of the plan. Moreover, since public opinion is unlikely to sway the actions of the Supreme Court, the next best option would be for the public to reach out to their congressional Representatives and Senators to pass new legislation that may aid in student loan forgiveness.

Although the future of Biden’s plan to forgive student loans seems uncertain for now, public action has the capacity to bring about the same loan forgiveness through more reliable means.